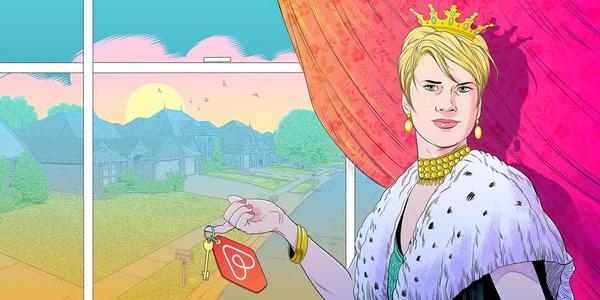

The meteoric rise — and spectacular fall — of the Queen of Airbnb

On a mild Tuesday evening in early 2022, some 150 people packed into the VFW hall in Tulsa to hear the Queen of Airbnb make her pitch.Post-pandemic, with interest rates low and travel once again booming, Airbnb listings had been popping up all over the city. For average investors, the back-of-the-napkin math was irresistible. In Tulsa, you could buy a suburban-style home for less than $75,000 and rent it out for $117 a night.